The junior mezzanine debtor claims its control interest in the initial mezzanine borrower as the guarantee on the junior mezzanine lender

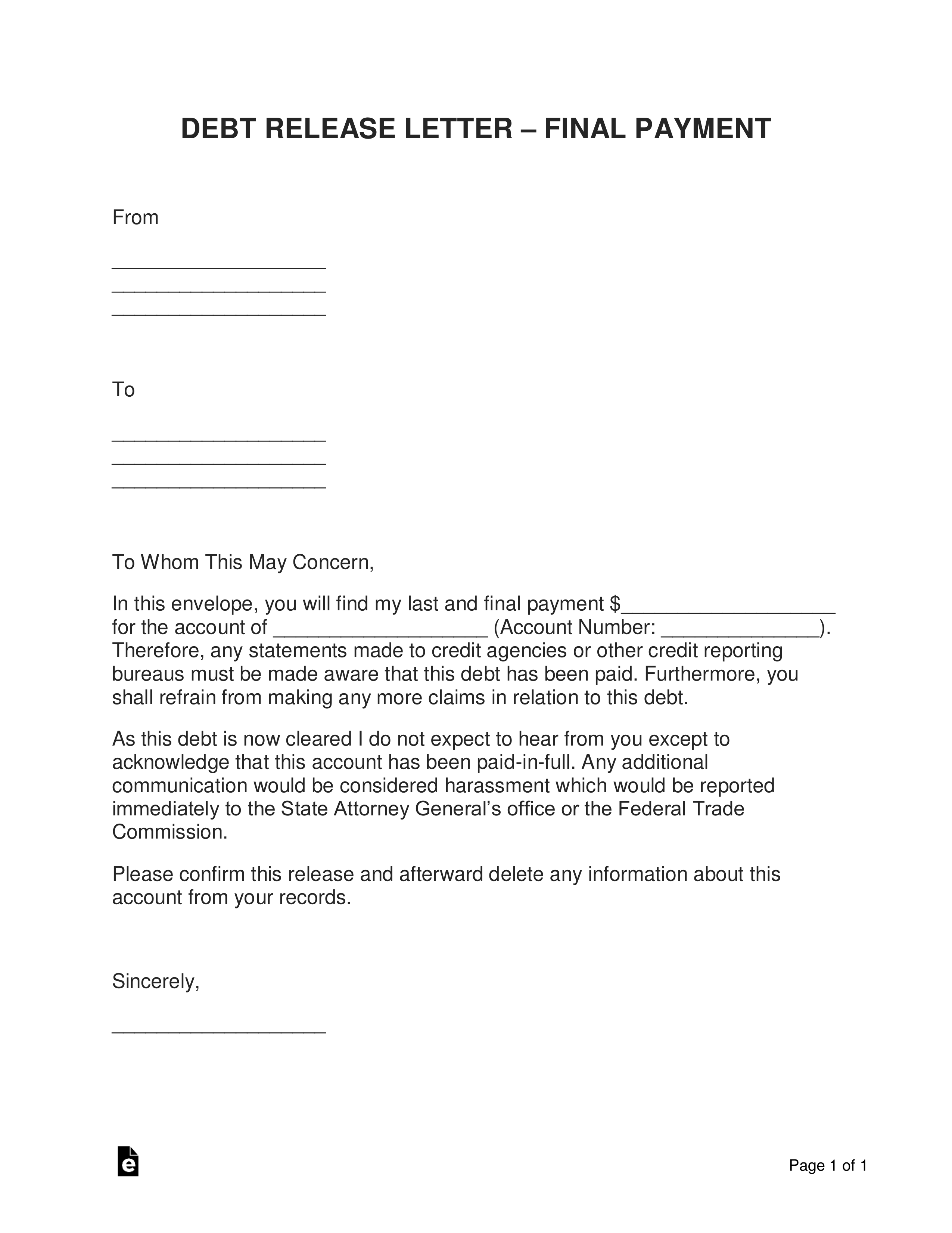

The fresh Cash Processes currently makes it necessary that this new mezzanine bank need a pledge of the collateral passion of your own organization you to definitely owns the underlying home. Which criteria contemplates merely just one quantity of mezzanine money. In practice, but not, an individual mezzanine mortgage can often be perhaps not adequate to complete the fresh entire pit throughout the investment stack, whereby the new debtor can get get a minumum of one junior mezzanine money. A beneficial junior mezzanine mortgage was structurally subordinated for the older loans, similar to the mezzanine loan represented on the visual a lot more than, but it’s after that taken from the root a residential property in the the fresh business structure. Like, brand new junior mezzanine borrower typically has 100% of one’s first mezzanine debtor, together with very first mezzanine borrower possess 100% of LLC you to definitely keeps the actual estate. According to the Funds Procedure, REITs are permitted in order to provide only at the initial mezzanine level.

In the event the REITs was limited to credit here at the original mezzanine top, it will notably influence their capability in order to serve the latest increasing you need to own mezzanine resource. As such, the Cash Procedure would be updated to incorporate you to an effective junior mezzanine mortgage complies into the REIT Standards provided (1) the borrowed funds is secured of the a promise of the collateral interests within the an entity one to, ultimately as a consequence of a minumum of one advanced forgotten entities, possesses an interest in a forgotten organization one to retains a house, and (2) for each advanced forgotten organization is the owner of only about a good de minimus amount of non-a house possessions. thirty-six

Connection Contract Conditions

Within the Money Processes, in the event that an effective mezzanine mortgage is protected by the a desire for an excellent relationship, the connection arrangement ought to provide one, abreast of a default and property foreclosure, the other couples will not unreasonably oppose the fresh new admission of one’s mezzanine bank because the a partner. It demands try difficult because most connection preparations do not tend to be particularly a supply. The purpose of the necessity appears to be making certain that, up on a default and you may foreclosure, the REIT are certain to get secondary usage of the underlying a home to meet up with the debt. You to goal are adequately served without having any difficult provision, not, so long as the partnership agreement and you may appropriate laws do not decrease the new promise from relationship appeal or even the admission of brand new people. As such, the existing union agreement specifications shall be modified to require, rather, that the connection arrangement and you may applicable law shouldn’t (1) exclude the latest couples away from pledging if not encumbering the union passion, otherwise (2) need the agree of one’s other couples to the entry away from a different mate. 37

End

The necessity for mezzanine capital is actual and you will growingmercial attributes as much as the world try dropping to your receivership, hire-increase systems are boarding right up windows, consumers and you will lenders is actually unable to negotiate exercising. We all have a shared interest in to avoid a cards crisis. REITs represent a much-necessary supply of additional mezzanine capital, however the Cash Techniques with its current form has actually a lot of REITs to the sidelines. New Internal revenue service would be to seize as soon as and you can open this trove off a lot more financial support by updating the Cash Process because the revealed significantly more than.

5. It holds discussing the regards to the brand new older mortgage can get restrict otherwise impact a good mezzanine lender’s entry to the brand new guarantee.

six. Because the talked about less than, sometimes borrowers get an elderly mezzanine loan and something or higher showed within section, the elderly mezzanine financing would be secure because of the equity passion regarding Home loan Borrower, and you may, and in case https://paydayloansconnecticut.com/plantsville/ you will find merely just one junior mezzanine financing, the newest junior mortgage might possibly be safeguarded of the collateral hobbies in the the new Mezzanine Borrower. A supplementary entity was shaped having 100% out-of Mezzanine Debtor, and therefore organization certainly are the Junior Mezzanine Debtor.