S., the high quality limit limitation toward back-prevent ratio is actually 36% into the conventional mortgage money

Debt-to-earnings proportion (DTI) ‘s the proportion out of overall loans money split of the revenues (in advance of tax) shown due to the fact a share, usually on the possibly a month-to-month or annual base. Due to the fact a fast analogy, if someone’s month-to-month earnings is actually $1,000 and additionally they spend $480 with the obligations monthly, the DTI ratio are 48%. If they had no personal debt, their proportion was 0%. There are different types of DTI percentages, many of which is actually said in detail lower than.

There is certainly an alternate proportion known as borrowing from the bank usage proportion (possibly titled financial obligation-to-borrowing ratio) which is often discussed together with DTI that works well a bit in different ways. The debt-to-borrowing from the bank ratio is the portion of simply how much a borrower owes versus their borrowing limit and it has an effect on its credit history; the better the fresh commission, the low the credit score.

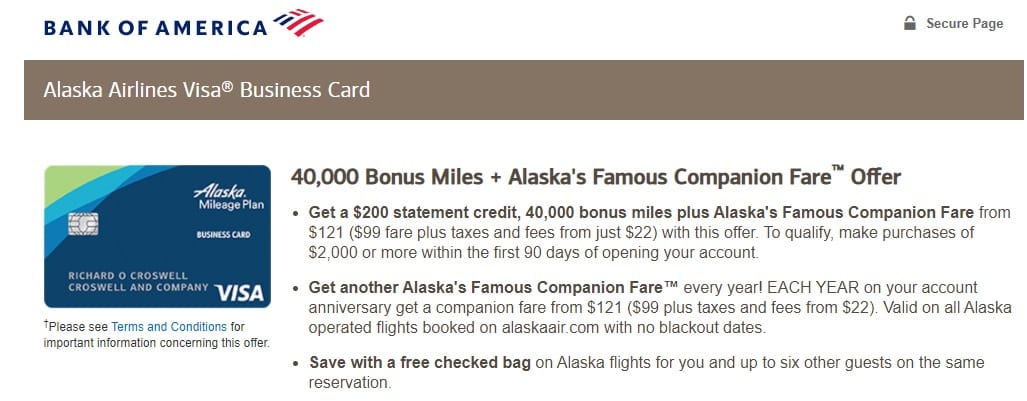

DTI is an important indication out of someone’s otherwise a good family members’ obligations top. Loan providers utilize this figure to assess the possibility of financing to them. Credit card issuers, collectors, and you can vehicle investors is most of the explore DTI to assess its risk of performing company with assorted someone. A person with a leading proportion can be seen by loan providers given that somebody who may possibly not be in a position to pay-off whatever they are obligated to pay.

Some other loan providers provides various other standards for what a fair DTI was; a credit card issuer you are going to glance at you aren’t an excellent forty five% ratio just like the acceptable and you elitecashadvance.com/loans/parent-loans/ can material them a charge card, however, an individual who brings personal loans get view it due to the fact also high and not offer a deal. It is just you to definitely signal used by loan providers to assess brand new likelihood of for each borrower to decide whether or not to expand an offer or otherwise not, and in case therefore, the characteristics of one’s loan. Technically, the reduced the brand new proportion, the higher.

Front-end debt proportion, either entitled mortgage-to-earnings proportion relating to family-to purchase, is computed of the separating complete month-to-month casing will cost you because of the month-to-month terrible income. Leading-end ratio includes just rental otherwise mortgage payment, as well as almost every other costs associated with housing eg insurance, possessions fees, HOA/Co-Op Commission, etcetera. About You.S., the quality restrict front-avoid restriction used by antique mortgage lenders is twenty eight%.

Back-stop obligations proportion is the significantly more the-encompassing loans from the a single or domestic. It provides all things in leading-stop proportion making reference to housing will set you back, and additionally any accumulated monthly personal debt such car and truck loans, student loans, credit cards, etcetera. It proportion is often recognized as the new well-known personal debt-to-money ratio, which will be alot more popular versus front side-avoid proportion. About You.

Household Value

In america, lenders play with DTI to help you meet the requirements domestic-buyers. Normally, the leading-stop DTI/back-end DTI restrictions to have traditional money was , the Government Houses Administration (FHA) limitations was , and the Virtual assistant loan limitations is actually . Feel free to fool around with our home Cost Calculator to check on this new debt-to-money percentages whenever choosing the maximum mortgage mortgage number to possess for every qualifying home.

Monetary Health

If you’re DTI percentages are widely used since tech tools from the loan providers, they can also be used to check on personal economic fitness.

In the united states, generally, a DTI of just one/step three (33%) or shorter is recognized as being manageable. An effective DTI of just one/dos (50%) or higher are believed too high, since it function at least half money are invested exclusively for the loans.

How to Straight down Loans-to-Money Proportion

Increase Money-You can do this because of working overtime, taking on the second work, asking for an income improve, otherwise creating funds from an interest. If the loans height remains a comparable, increased income will result in a lower DTI. Another way to lower the proportion is to lower the debt count.

Budget-Of the tracking investing using a funds, it is possible to see places where expenditures will be slash to minimize obligations, whether it is holidays, dining, otherwise looking. Extremely costs and make it possible to song the degree of debt as compared to earnings on a monthly basis, which can only help budgeteers work at new DTI desires they place for themselves. To learn more on or even perform computations of a resources, please go to the brand new Finances Calculator.

Create Financial obligation Economical-High-interest debts such as for example credit cards can possibly end up being reduced as a result of refinancing. An excellent starting point is always to label the credit cards company and get if they can lessen the interest rate; a borrower that usually will pay their expenses on time having a keen membership into the a good reputation can sometimes be provided a reduced speed. Yet another means is to try to combining all of the large-notice financial obligation on the that loan with a diminished interest. For more information on or perhaps to do computations associated with a cards cards, please visit the financing Credit Calculator. To find out more in the or even to create calculations involving debt consolidation reduction, please visit the debt Integration Calculator.