Benefits and drawbacks of going a home loan As a consequence out of USAA

Are you ready to buy your new home? While a past or most recent person in the new army, or linked to a member of the armed forces you must know getting your financial or monetary as a consequence of USAA bank. The latest Entered Characteristics Car Commitment try seriously interested in offering the folks with offered all of our country offering insurance policies procedures, loans, and you may financial selection.

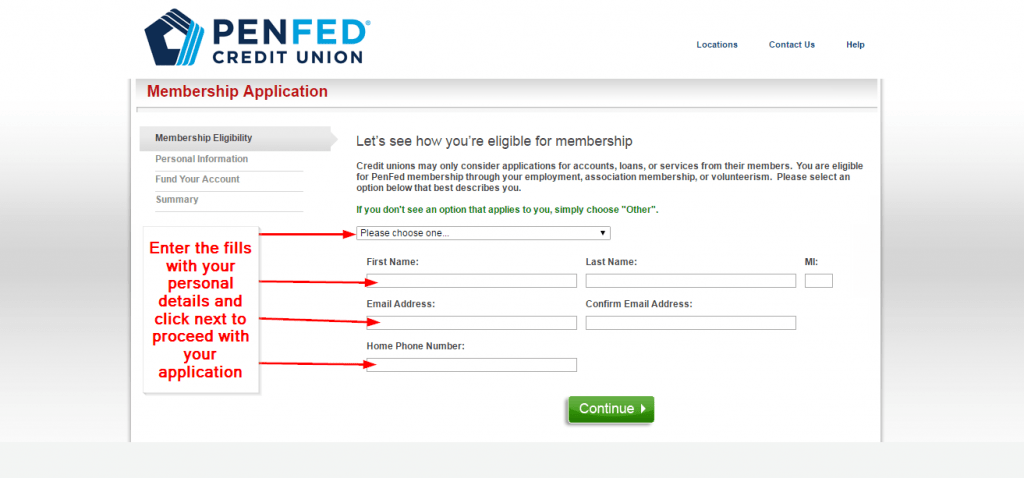

- Delivering pre-acknowledged

- Trying a real estate agent

- Completing your property mortgage app

- Meeting recommendations

- Closing in your dream domestic

Why don’t we search in the USAA mortgage loan possibilities, cost, charges, credit score standards and you can even though you would want to such as for instance USAA.

USAA Mortgage loans and you can Lenders

USAA financial now offers Virtual assistant financing, traditional capital, and you will jumbo financial support of up to $step three million. They don’t provide FHA otherwise USDA money. Here’s even more information about the loan currency USAA also offers.

Va Finance

Va lenders is simply multiple financial offered because of the Your.S. Department regarding Masters Situations, meaning it put certain requirements of them currency and additionally make sure the mortgage nonetheless they usually do not originate the loan this is where USAA comes in.

With almost one or two-thirds of the mortgages backed by the newest Virtual assistant, talking about USAA’s specialization. USAA has the benefit of repaired-rates Virtual assistant mortgage loans with the ten, ten, 20, and you may 31-12 months fine print; in addition to 29-one year jumbo Virtual assistant fund and you may a great 5/step 1 variable rates mortgage alternative.

Va investment is only getting gurus, army people in addition to their head dependents. Virtual assistant money provide positives, plus no deposit required to obtain the capital. You can learn facts thereby applying for a financial loan in the USAA’s Va Financial webpage.

USAA Mortgage loans

Antique financing available in 29, 20, ten, and you can ten-12 months fixed-price conditions. The regular mortgage is a fantastic selection if you are looking so you can present no less than 5 % on your own real estate loan. There was finance in the Fenwick newest USAA financial costs at this site.

Conventional 97 finance as an option to brand new FHA financing and you will best option for basic-day home buyers. These funding are located in 29-12 months terms and conditions and invite to have an advance payment very little once the step three % of one’s done loan amount. As well, conventional 97 mortgage people don’t need certainly to well worth economic insurance policies, that will slash a great deal of alter, typically, $a hundred thirty day period.

Jumbo home loan options are along with available for 15 and you have a tendency to 31-season terms and conditions. The newest USAA jumbo mortgage installment loans online in Louisiane you want a beneficial 20% put therefore the brand new Va jumbo financing helps it be easy for a lowered downpayment but merely even offers a thirty-year name. USAA even offers a great Va 5/step 1 varying pricing jumbo mortgage alternative. Jumbo finance are usually useful currency with a minimum of $453,one hundred.

When you’re selecting refinancing your current home loan, look at the Va Interest Cures Refinance loan (IRRRL) no origination payment. USAA talks about the fresh identity, assessment, and Virtual assistant money charge to possess IRRRLs.

USAA has the benefit of money and you will refinancing alternatives for vacation and also you will get currency attributes, and you may adjustable rates mortgage loans. It recommend calling the customer service diversity from the 800-531-0341 if you want to discover more about such selection.

USAA Home loan Cost and you may Will set you back

Financial costs are practically always altering, but you can view the current USAA costs toward most recent Financial Can cost you web page. It article the costs online day-after-date, and won’t customize its price centered on your credit score if not mortgage factors. Nonetheless they maintain consistent costs across the United states, in which almost every other loan providers you can easily to evolve rates due to the new venue. USAA financial pricing are recognized to compete on the market, but not, that does not mean dont store your options.

- A minimum FICO exit 620.

- No less than loan amount regarding $50,100.

- A maximum loan amount away-from $step three billion.

USAA fees a one area, otherwise 1 percent, payment into the lenders, and always cover even more charge and costs one to to prospects perform make up whenever using an enthusiastic choice financial.

Regardless of how your own borrowing turns out if you’re not a USAA associate. You need to be an effective USAA representative to try to get an effective USAA real estate loan if you find yourself should be an active people throughout the the latest armed forces, a direct dependent out of an armed forces user, if not possess honorably provided prior to now getting an effective USAA user.

The minimum FICO get you ought to apply for an effective USAA economic try 620. USAA does not think choice borrowing data. Although not, for maximum can cost you aside-of every financial, you really need to get score up for the a beneficial level of 740 or maybe more. Know how to look for a property that have bad if any borrowing from the bank if you find yourself not able to get to the lowest credit score for an excellent USAA financial.

Not everybody get the fresh USAA mortgage loan options to functions in their eyes and that’s Okay. USAA also provides style of attractive masters such as for example no undetectable charge, user-friendly online possibilities, monetary suggestions, a bona fide possessions gurus network, and you may an one+ get about Bbb.

But some people enjoys conveyed affairs of support service and you will disorganization about your loan application process. you will be unable to discover stone-and-mortar towns and cities if you like to do team in person alternatively than just on line or even more the computer.

Alternatively, USAA is consistently improving the on line guidance, attempting to make it more convenient for guys doing the brand new done loan techniques online. And USAA offers aggressive financial rates which means you can also be the participants. If you’re looking to offer, get a hold of, otherwise re-funds your residence and you are clearly currently a great USAA affiliate think about your choice here earliest.