Best Banking companies Bringing Secured personal loans from inside the Asia

When you are there are many different version of loans readily available, he could be generally categorized to your secure and you may signature loans. In this article, we will consider secured loans, its has actually, and you may advantages.

A guaranteed mortgage is a loan that requires collateral in order are disbursed. Guarantee or shelter ranges regarding functions, gold, automobile, etcetera.

The existence of collateral will make sure your financial possess one thing to-fall back on in instance your default on your financing. This means that the eye rates is straight down to own this type of loans because chance is lower to your lender.

Auto Loans

Automobile money, also known as automobile financing, try secured finance the spot where the bought vehicle will act as security. The lender transfers the fresh possession of one’s vehicles into the title once you’ve reduced the mortgage.

Mortgages

A mortgage are pulled against any assets you very own. The lending company works a great valuation of the house while offering your financing consequently. You may then make use of this amount borrowed the purpose, and have your house released when you pay off the loan.

Show otherwise Savings-secured personal loans

Such secured loans use the loans on the bank account as the collateral. According to the valuation, the borrowed funds count is approved.

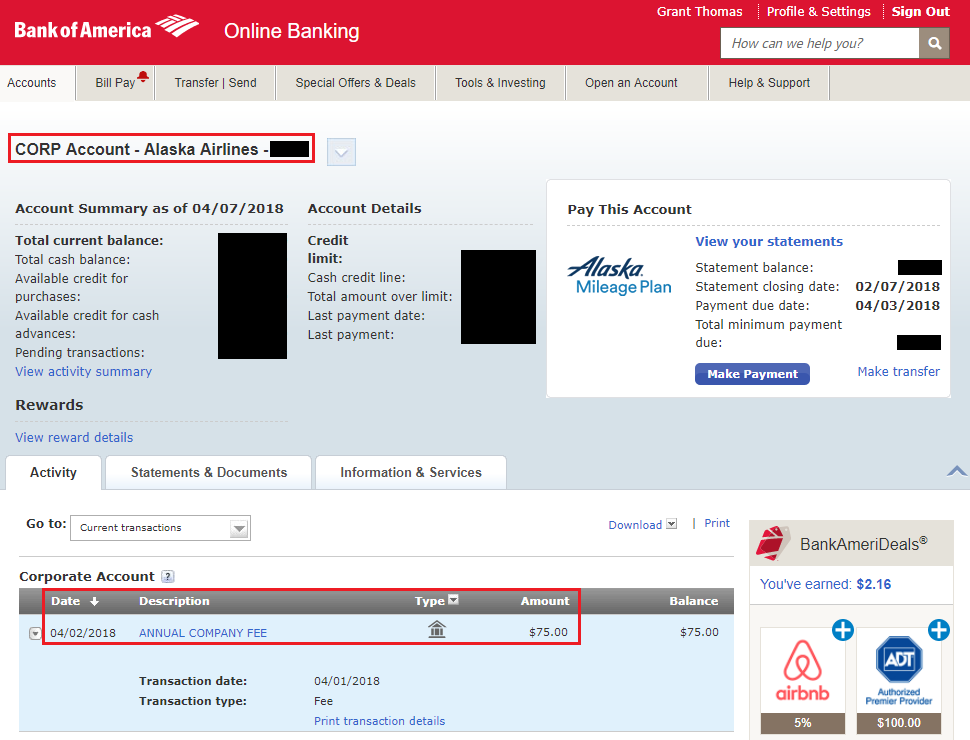

Safeguarded Credit cards

This type of performs just like normal playing cards but are given facing a predetermined put. Your own borrowing limit could be as much as 75-80% of deposit number.

Shielded Lines of credit

In case of a line of credit, you have an appartment restriction and acquire one count within it. After you pay it back, the new limit once more rises with the limit amount. A guaranteed line of credit works in the same way but exists to you personally facing a secured item otherwise guarantee.

Vehicles Name or Pawnshop Fund

In such finance, you need your car identity or other beneficial, eg accessories, devices, etc. once the collateral. You should be cautious in the like finance due to the fact attention pricing are usually highest, and you can dump your resource if you fail to pay back the mortgage.

Term life insurance Fund

Just like almost every other secured finance, in such a case, you can keep the insurance due to the fact equity. With respect to the bucks worth Columbine loans of their rules, your loan amount and you will terminology is decided.

Poor credit Fund

These financing is for those who have a dismal credit record. It works identical to shielded LOC, finance facing coupons, otherwise safeguarded credit cards. Simply keep in mind that a woeful credit get also a guaranteed mortgage get convert to highest interest levels.

Since we all know just what secured personal loans are in addition to their brands, let us understand where you could get secured loans. Let me reveal a listing of most useful finance companies that give secured finance –

Protected compared to Signature loans

Secured finance are supported by collateral such property, otherwise insurance rates, while signature loans do not have like support. Secured personal loans are a feasible choice for individuals with bad credit background or no credit rating anyway. They can even be a great fit if you’ve educated economic hardship and are generally looking for ways to rebuild the credit.

Exactly what are Loans Facing Ties (LAS)?

Finance Up against Ties are a variety of secure financing that requires pledging your own shares, mutual money, and coverage as the collateral for your financing. Instance funds are typically provided because a keen overdraft studio on the membership once you have deposited their bonds.

You need the brand new LAS business to attract money from your account, and you shell out appeal just on LAS number you employ and also for the several months you utilize it. These types of fund are right for individuals who want immediate exchangeability to possess individual otherwise company objectives and can pay them within this a primary period of time.

Achievement

Secured finance are offered facing equity otherwise a secured item. It gives banking companies or credit establishments additional guarantee about yourself settling the mortgage. For this reason secured personal loans often have down interest levels.

Its a smart idea to continue one idle house guarantee to obtain a loan in the less expensive words. Whenever you are cautious on make payment on EMIs timely and you may handling your money, it can be extremely effective for you. But not, for individuals who standard, you have the threat of your shedding your asset.

Covered Mortgage Related Faqs

Secured personal loans is loans given to individuals against guarantee. Financing candidates normally guarantee their property otherwise any house as equity towards financial.

Within the personal loans, borrowers dont promise security. Instead, loan providers offer the brand new finance according to research by the applicant’s creditworthiness. This type of money incorporate higher rates of interest while they angle a risk toward bank.

Since the secured finance require consumers to guarantee its possessions since collateral, when a debtor non-payments toward mortgage, the financial institution comes with the directly to offer the newest collateral in order to retrieve the bill loan amount.