2022 FHA Mortgage Restrictions for all Ca Areas

For over twenty two ages my personal party and i possess lead reasonable FHA home loan costs from inside the California also punctual closings and you can business-top customer support. All of our FHA mortgage applications can be used for each other refinance and you will purchase purchases. All of our client-very first method to this new FHA financing process function we shall pay attention very first next discover ways to meet your property financing means. Get in touch with https://paydayloanalabama.com/rockford/ me personally today to have a zero-cost/no-obligations estimate to discover why are you some other.

Put another way; it is an insurance policy you only pay monthly which covers an excellent lender’s losses just in case you default in your FHA financing. Read more in the MI here.

The FHA provides a max loan amount that it will insure, that is known as the FHA credit restriction. These types of mortgage limits try determined and you may up-to-date a year and generally are swayed by the antique mortgage limits lay by Federal national mortgage association and you will Freddie Mac computer. The kind of house, including solitary-members of the family or duplex, may also connect with such wide variety.

You can notice that very California counties possess an FHA Mortgage Restrict regarding 420,680 to possess a single-house. Higher-charged aspects of California like Almeda, Contra Costa, Los angeles, Marin, Lime, San Benito, San francisco bay area, San Mateo, Santa Clara, and you will Santa Cruz County all the keeps mortgage restrictions of 1,149,825 to own an individual-home. It is because more expensive belongings for the reason that urban area. Other areas slide somewhere in anywhere between these floor and you can ceiling wide variety.

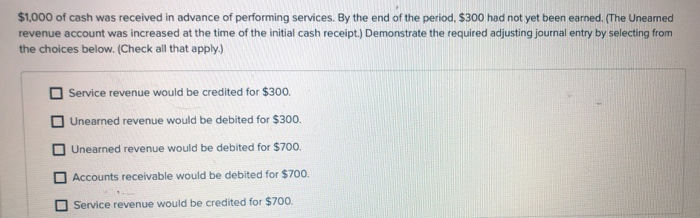

This new table lower than provides the 2022 FHA Financing restrictions for everyone areas for the California, listed in alphabetical acquisition. Within this dining table, step one product refers to one-family home, 2 device relates to a great duplex-concept house with a couple of independent residents, and so on.

Definition of a keen FHA Home loan

A keen FHA financial try a home loan that’s secure from the authorities, particularly the Government Construction Government. Generally, because of this if a debtor quits investing and you will will lose its household into the a property foreclosure, the us government will make sure the lender doesn’t sustain people losses. You don’t in reality ensure you get your mortgage of FHA; you ought to explore an FHA-accredited financial. Just like the the lenders need to originate its FHA loans according to research by the exact same key advice, you will need to compare your own home loan options when taking an FHA financing.

Benefits of a keen FHA Financial

FHA mortgage loans have numerous professionals that very make change to possess basic-go out homebuyers otherwise consumers with reduced-than-best credit. Some of the great things about a keen FHA mortgage range from the following the:

Low down Percentage

FHA mortgages need as little as step three.5 % down. This is exactly among the many low down repayments of every mortgage unit on the market today. Conventional items normally wanted between 10 and you will 20 percent down, so this is a large advantage to people who have a small less overall from the lender.

More straightforward to Meet the requirements

The entire need the us government come the FHA program would be to help extend mortgage loans in order to individuals after and during the nice Depression. FHA have proceeded their legacy regarding putting homeownership contained in this way more people’s arrived at insurance firms broader financial guidelines.

Assumable

You to definitely book feature regarding FHA mortgages is that they try assumable. This is why anyone may suppose your property mortgage after you offer, whenever they qualify of course. This will be a massive work with whenever interest levels go up, because low interest of one’s FHA mortgage will likely be thought by your home’s the residents.

Co-Candidate and you can Current Loans

For these in need of a little extra force to get going, and for individuals with family gifting all of them money, FHA allows for both co-applicants and current fund. Co-people actually be eligible for and generally are guilty of the mortgage which have you. While there is zero requisite as to which actually pays the fresh new mortgage, it ought to be paid down into-date every month, or else you will both be kept accountable. Current fund are used for a percentage or all of the downpayment for the FHA mortgage.