To evaluate restriction loan amount, among the many situations i envision is your debt-to-money ratio

- Personal protection number for you and your spouse when the each other people try trying to get the mortgage

- Copies of your checking and you will savings account statements for the past 8 weeks

- Proof of any kind of property instance ties otherwise holds

- A few current straight paystubs as well as 2 most recent W2’s detailing your earnings

- A list of most of the mastercard levels as well as the calculate month-to-month amounts due for each

- A summary of account numbers and you can stability owed on the an excellent loans, instance auto loans

- Copies of one’s last dos years’ income tax statements

- The name and you will address of somebody who can be sure their a position

- Your loan manager will tell you or no much more information are requisite

How do you dictate the utmost loan amount to manage?

Centered on general computations, the home loan repayments should not be any over 29% away from revenues. The borrowed funds fee, combined with non-casing costs, will be full just about 41% of money ( not, dependent on your unique loan condition, you may also qualify that have a mixed debt so you’re able to earnings proportion because the highest as the 50%).

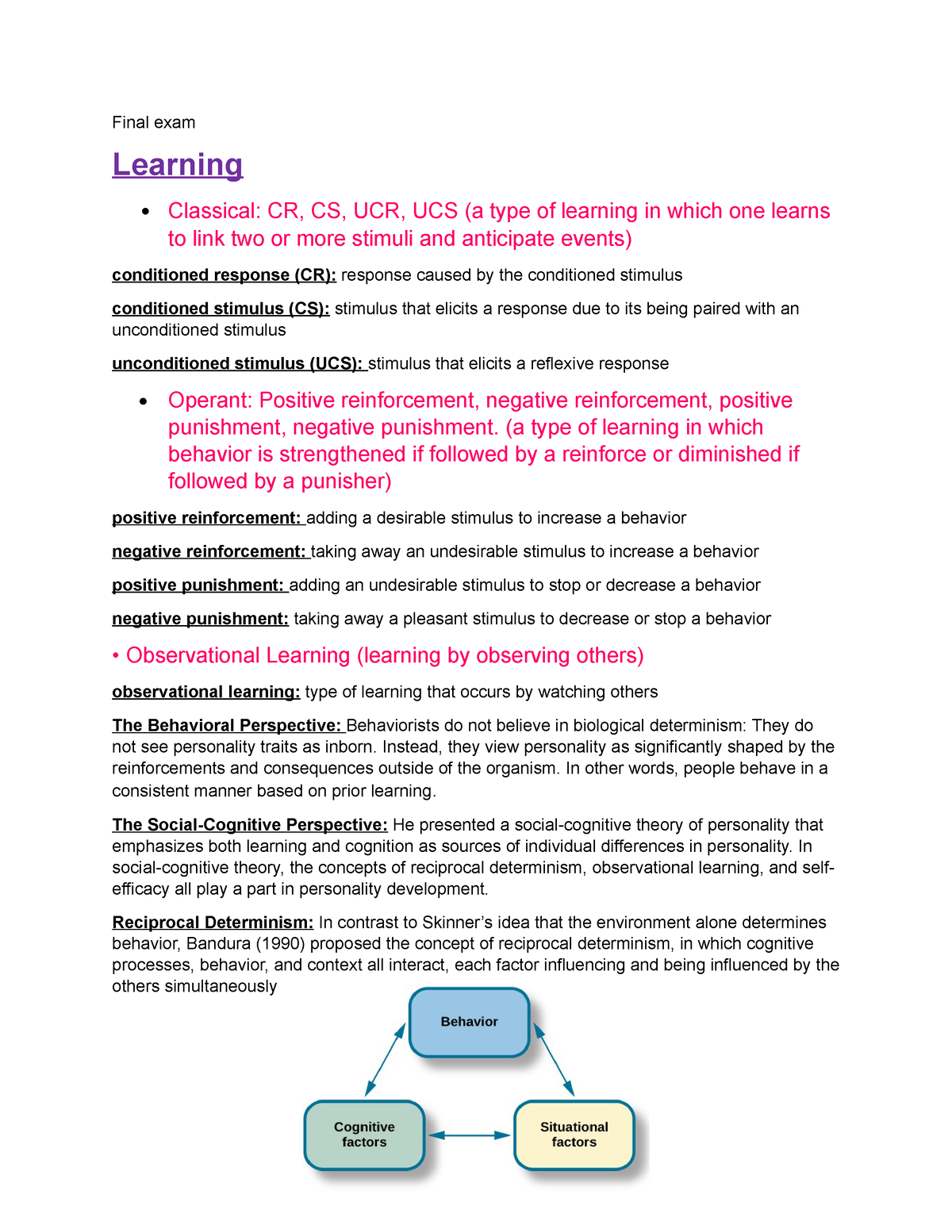

This really is an assessment of your gross (pre-tax) income to casing and you may non-casing expenses. Non-property expenditures become much time-label expenses eg vehicles or education loan or bank card money, alimony, otherwise youngster support. We also consider the amount of dollars you have available to own down payment and you can settlement costs along with your credit history.

About how big your own advance payment, think that you’ll in addition need money to have closing costs, moving expenditures, and perhaps, fixes and painting. You will find mortgage options available that simply need a down payment of 3% or less of the cost.

The higher the latest down payment, new shorter you must acquire, additionally the much more collateral you will have advance cash Rainsville Alabama. Mortgage loans that have lower than a beneficial 20% down-payment basically require a home loan insurance, entitled Private Mortgage Insurance rates (PMI), so you’re able to contain the loan.

It expenses relies on a lot of items, not merely the cost of the house additionally the version of mortgage you desire. You should intend to build enough money to fund three will set you back: serious currency the new deposit you make into house after you fill out your own render (to show toward provider you are seriously interested in looking for buying our house), the fresh down-payment (a percentage of your cost of our home that you have to pay when you go to settlement), and you may closing costs (the expenses for the control the latest documents to shop for a property.)

You’ll pay the settlement costs in the payment. It number averages step three-4% of your own cost of your residence. This type of will cost you protection individuals charges and running expenditures. Once you submit an application for the loan, we’ll make you an offer of the closing costs, you will never be caught because of the surprise.

What’s “mortgage so you’re able to really worth” (LTV) as well as how can it determine how big is my personal mortgage?

The borrowed funds so you’re able to value ratio is the amount of cash you acquire in contrast to the price or appraised worth of the house youre to shop for. For each mortgage provides a certain LTV limit. Such as for example: Which have a beneficial 95% LTV financing towards the a property priced at $fifty,000, you might borrow to $47,five hundred (95% away from $50,000), and you may would need to spend,$dos,five-hundred because the a deposit.

The new LTV proportion reflects the level of guarantee borrowers keeps inside the their homes. The better the fresh LTV new less overall homebuyers are expected to pay out of one’s own fund. To guard loan providers facing prospective lack of case of standard, high LTV fund (80% or even more) constantly require a mortgage insurance.