Resource Mortgage Nebraska , once the a direct Nebraska Mortgage lender, handles the whole credit procedure from beginning to end

Lenders inside the Nebraska

This is Financial support Home loan Nebraska, where we try to incorporate Nebraska Home loans in order to Nebraska homeowners and you may people at competitive cost and you may fees whenever you are offering great service. First, we would like to thank you toward chance to earn the providers. I understand that obtaining a home is a vital choice of most man’s lifetime, that is the reason Investment household Financial Nebraska has the benefit of dedicated facts of get in touch with regarding mortgage processes. Which ensures an inconvenience-free feel, having an in-go out close. After all, to get a home is enjoyable.

All of our for the-home control and you may underwriting allows getting brief, sensible approvals and you will quick closings. I’ve over control of everything in the application to help you capital.

Funding Home loan Nebraska try a full-solution Nebraska Mortgage lender which provides a variety of home loan circumstances also aggressive Nebraska Financial Prices. Whether you are a first-big date consumer looking to an effective Nebraska FHA Mortgage , finding a rural property and you will in need of good Nebraska USDA Domestic Mortgage , a native Nebraskan trying to utilize the HUD 184 Nebraska Indigenous Western Financial , a beneficial active or resigned experienced trying to find a keen Nebraska Virtual assistant Home loan , or a seasoned client needing good Nebraska Old-fashioned Home Loan , we have been right here to simply help.

Nebraska , is located in the latest Midwestern side of the You, often is referred to as the new Cornhusker State. the administrative centre are Lincoln, when you are Omaha is their biggest town and you can monetary center.

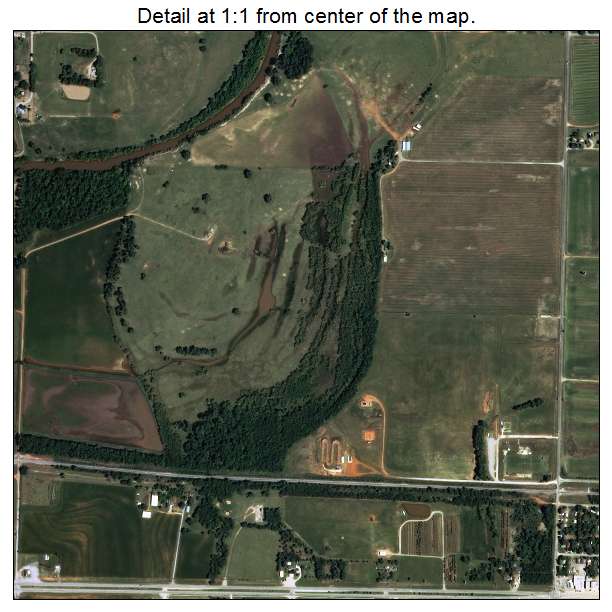

Nebraska is known for the greater flatlands, including the newest Midwestern Corn Strip additionally the High Plains. The latest nation’s borders are as follows: Ohio towards the south, Southern area Dakota into the north, Tx toward southwest, Iowa toward east, Missouri towards the southeast, and you can Wyoming into the western. The new Missouri River models the state’s east line.

Being an agricultural county getting much of its records, corn, soybeans, animal meat cattle, pork, and you may poultry all are significant elements of Nebraska’s benefit. But in the last few decades, it is more varied, with significant contributions regarding the manufacturing, It, insurance, transport, and you may service circles.

Multiple colleges, such as the College or university out of Nebraska system, with campuses from inside the Lincoln, Omaha, Kearney, or other urban centers, come into Nebraska. These universities help innovation, look, and you will knowledge across a variety of specialities.

The state will bring several outside and you may social sites. There are galleries, theaters, and sounds sites in Lincoln and you may Omaha’s thriving arts and you will community circles. Brand new Platte Lake, this new Sandhills region, and several county parks having hiking, hiking, and animal enjoying choices are the Nebraska’s natural internet.

Nebraska possess five line of 12 months and you may a continental climate. Winters can be frigid and you will secured in accumulated snow, while you are summertimes usually are mild with sporadic thunderstorms. Mild climate and you will changing leaves is properties of your own springtime and slide year.

Ahead of Eu explorers and you will settlers arrived, the bedroom is the place to find Indigenous Western tribes to possess tens and thousands of ages. During the 1854, Nebraska turned a territory, and in 1867, it turned into a state. Inside 19th century, the official is greatly mixed up in westward way, especially into the structure of your transcontinental railway.

Nebraska Mortgage brokers

Generally speaking, Nebraska are a varied and you will bright condition throughout the Western Midwest because brings a mix of outlying appeal, economic ventures, and you may social places.

Like other almost every other says, Nebraska’s market try at the mercy of swings with respect to the country’s benefit, populace progress, and you can rates of interest. In general, Nebraska’s market has grown continuously in recent times, having a modest increase in construction cost.

When compared to of a lot coastal states, property choices for the Nebraska are typically a whole lot more cheaper. Regional factors can affect construction affordability, too, as the average household speed from inside the urban countries such as for example Lincoln and you may Omaha are more than in the rural elements.

There are numerous brand of construction found in Nebraska, such as solitary-household members land, townhomes, rentals, condominiums, and you will rural holdings. New nation’s ranged geography now offers options for many way of life circumstances, away from trendy urban areas to help you secluded rural vacations.

Affairs plus consult of family, more youthful pros, and you can pupils affect Nebraska’s local rental field. You will find many different leasing available options to help you people during the metropolitan places such as Lincoln and Omaha, that have brilliant leasing avenues.

Within the Nebraska’s real estate market, outlying a home-with facilities, ranches, and you can amusement functions-is a significant world. The nation’s largest industry is farming, and you will outlying parts are crucial into state’s cost savings.

That have some homes solutions, effective leasing markets, and applicants in metropolitan and you can rural parts, Nebraska’s real estate market also offers a selection of opportunities for people, property owners, renters, and you may organizations.