How Much Do Bookkeepers Make?

Contents:

The more information you can give your CPA at tax time, the more deductions you’ll be able to legitimately claim, and the bigger your tax return will be. The ability to communicate effectively is important since you’ll need to interact and discuss financial matters with either an employer or your clients. Computer and math skills are also required since you’ll be computing numbers regularly with the help of bookkeeping software programs. Whether you’re looking for a bookkeeping job “near me” or you’d like to find a remote opportunity, there are several strategies and tips for finding a part-time or full-time bookkeeping job.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

Earning this designation is a common goal of many accountants. You must have a minimum of 150 postsecondary education hours, or what amounts to a bachelor’s degree in accounting, and an additional 30 hours of graduate work. Most CPA candidates go ahead and finish their master’s degrees. For professionals and aspiring bookkeepers alike, certifications are a powerful way to boost your skills and add additional authority to your brand. You can gain certifications in bookkeeping itself as well as in the accounting software you plan to use to serve your clients.

Where to start

Some industry experts believe that not enough https://bookkeeping-reviews.com/ are emerging to fill available job openings, indicating opportunities for professionals with the right skills. Credentials like the CB and CPB certifications may also help bookkeepers develop the superior skills that boost their overall compensation rates. Industry observers agree that software improvements have made bookkeeping more efficient.

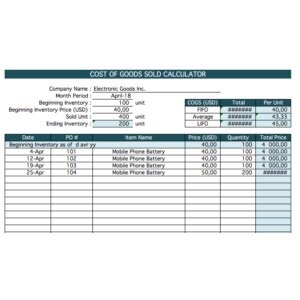

Under the accrual method of accounting, the expenses should be reported in the same accounting period as the related revenues. If that is not certain, then an expense should be reported in the accounting period in which its cost expires or is used up. Operating expenses are the expenses incurred in earning operating revenues.

The Accounting Cycle: 8 Steps You Need To Know – Forbes

The Accounting Cycle: 8 Steps You Need To Know.

Posted: Wed, 08 Mar 2023 18:00:53 GMT [source]

Work on your target market at the same time as your niche and UVP. The right business structure depends on your business goals, whether or not you want to raise capital, and the amount of personal liability you want to take on. Also, during the interviewing process, candidates must perform a Skills and Speed test to determine if they can do the job to your standards. To have a 6-figure business, you’ll likely need to increase what you charge. Unfortunately, solely word-of-mouth advertising won’t do the trick.

How to become a virtual bookkeeper

We need your permission to do things like hosting Your Stuff, backing it up, and sharing it when you ask us to. Our Services also provide you with features like eSign, file sharing, email newsletters, appointment setting and more. These and other features may require our systems to access, store, and scan Your Stuff. You give us permission to do those things, and this permission extends to our affiliates and trusted third parties we work with. You can access, amend, download, and delete your personal information by logging into your account. Our Services display information like your name, profile picture, device, and email address to other users in places like your user profile and sharing notifications.

Most companies use computer software to keep track of their accounting journal with their bookkeeping entries. Very small firms may use a basic spreadsheet, like Microsoft Excel. Larger businesses adopt more sophisticated software to keep track of their accounting journals. If you use cash accounting, you record your transaction when cash changes hands.

Get FREE Tax Updates

I know that many people in BBL have had some experience before they took the course, but I knew literally nothing. After much conversation, I decided to start the training full time and I did that and set up the business until June of 2018, when I quit teaching and jumped completely into bookkeeping. In terms of average pay rates, BLS data from May 2021 identifies the District of Columbia, Massachusetts, Washington, California, and Connecticut as the top-paying areas. Regarding overall job numbers, the BLS ranks California, Texas, Florida, New York, and Pennsylvania as the states with the highest employment levels. Also, note that the degree-related salaries cover all accounting professionals who hold that degree. James M. Tobin is a writer, researcher, and editor specializing in student reference and academic research materials related to technology, business, finance, law, and the humanities.

Maybe you decide to take one class per year at $300, which would break down to $25 a month. A computer is a bookkeeper’s largest asset because you can do everything you need to from it. This is something I suggest you save money for each month in case you need to replace your old computer down the road.

You need it to do your taxes

It is crucial to ensure that you don’t mix your personal and business finances. Paying for business expenses out of your personal account or vice versa can lead to confusion. Inaccurate records and potential tax issues can also cause issues internally. Using the accrual accounting method, you record income when you bill your customers, in the form of accounts receivable (even if they don’t pay you for a few months). Same goes for expenses, which you record when you’re billed in the form of accounts payable. Active income is considered a low-risk form of profit earning.

You can grow your list through your website and create simple campaigns to start. As you increase your email marketing know-how, you can develop more complex campaigns to reach prospective clients. We’ve already talked about your ideal customer; your market and client research should help to inform you where they spend their time. Now let’s look at some common marketing channels you can use to promote your business.

As for certification from AIPB, members pay $479, and nonmembers pay $574. The price of this certification includes the cost of enrollment, workbooks and the four-part national certification exam. After passing the AIPB’s certification exam, you will be recognized as a certified bookkeeper. A bookkeeping certification is an official demonstration of a person’s bookkeeping skills. It’s a way to show your skill set to potential employers and others in your professional network.

Enrol and complete the course for a free statement of participation or digital badge if available. Free statement of participation on completion of these courses. Cecilia Seiter is a freelance writer and author based in Oakland, CA. She writes about education, corporate culture, renewable energy and the Internet of Things. You can also complete additional certifications to demonstrate your proficiency in advanced subtopics related to bookkeeping.

Plenty of them undervalue their services for various reasons, but for you to reach your business mountaintop, those days must be over. You’d think that’s an obvious thing to do, but it’s surprising how many bookkeepers don’t. When contacting accountants, we suggest you avoid cold calling since they’re typically not fond of that. Instead, dip into your current client roster and find out if they know accountants you can approach. Deb reached the 6-figure bookkeeping business mountaintop after years of struggling. You can’t figure out why your bookkeeping business hasn’t grown as you thought it would.

You can also bundle courses to save 36% as a member and 20% as a nonmember. Bookkeeping Basics takes about 16 hours to complete, and the Intuit Bookkeeping Professional Certificate takes about 4 months to complete at the suggested pace of 4 hours per week. Since these courses are fairly short, they may not be be enough to help you launch a career right away, but you can get your feet wet and see if bookkeeping is a potential fit.

4 Consequences of Bad Bookkeeping in Your Business – BOSS Magazine

4 Consequences of Bad Bookkeeping in Your Business.

Posted: Tue, 21 Feb 2023 08:00:00 GMT [source]

Depending on the type of leave management for xero system used by the business, each financial transaction is recorded based on supporting documentation. That documentation may be a receipt, an invoice, a purchase order, or some similar type of financial record showing that the transaction took place. By recording your expenses accurately, you can identify areas where you can reduce expenses. While making informed decisions to improve your business’s financial health.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

The bookkeeper is generally responsible for overseeing the first six steps of the Accounting Cycle, while the last two are typically taken care of by an accountant. While there is a general overlap between the two professions, there are a few distinctions that are later discussed in this article. When you want impartial advice, ask SLC Bookkeeping about our mentorship and consulting services. With SLC Bookkeeping, you can gain all the insights a CFO would provide without having to spend precious resources hiring another full-time employee. SLC Bookkeeping provides accurate and timely reporting that ensures your back office is CPA- and investor-ready.